Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

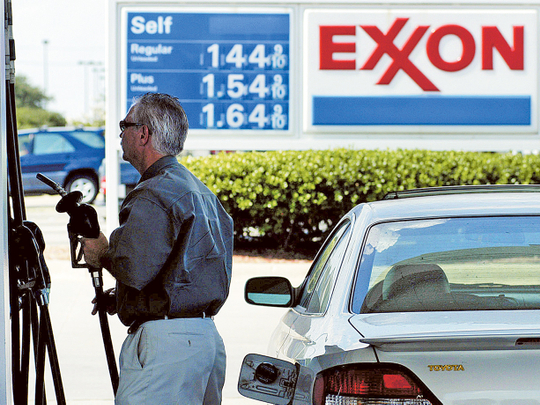

Oil majors are expected to report 2023 profits down by about a third from record levels in 2022, as oil and gas prices retreated from the peaks that followed Russia’s invasion of Ukraine.

Exxon results included a $2.5 billion impairment charge for California properties that it has been trying to sell for more than a year. Excluding that charge, annual income fell 35 per cent to $38.57 billion.

Top oil producers are writing off unwanted assets and cleaning up their balance sheets ahead of pending deals. Chevron has said it would take an about $4 billion impairment in the fourth quarter, while Shell on Thursday took a $5.5 billion writedown.

Exxon agreed in October to buy rival Pioneer Natural Resources to bolster its U.S. shale oil production in the Permian Basin, and Chevron proposed to purchase Hess Corp to get a foothold in Guyana. Both deals are expected to close mid-year.

Brent crude futures in the fourth quarter averaged $82.85 a barrel, a 7 per cent decrease compared to the same period last year and a 4 per cent decline from the third quarter. For the fourth quarter, Exxon reported a better-than-expected profit of $9.96 billion, or $2.48 per share, compared to $14.04 billion, or $3.40 per share, a year earlier.

The results were driven by higher trading profits in its fuels business and increased oil and gas production in the US and Guyana, Chief Financial Officer Kathryn Mikells told Reuters.

Fourth-quarter results were helped by Exxon’s trading division, which delivered a $1.1 billion boost to operating profit from its fuels business.

“That is definitely something that we would expect to see on an ongoing basis embedded in our results,” Mikells said. Gains came from revising how its specifies and moves fuels, she added.

Guyana and the Permian Basin pushed up capital spending in the quarter by 4 per cent over a year ago, and put full-year project spending at $26.32 billion.

The largest U.S. producer also said it planned $23 billion to $25 billion in capital spending this year to prepares for 2025 projects.

I have over 10 years of experience in the field of cryptocurrency and blockchain technology. I have attended numerous conferences and events around the world, and my work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and Yahoo Finance.