Bank of England Warns of Bleak Economic Outlook Leading up to UK General Election

The Bank of England is expected to predict a challenging period for the UK economy in the months leading up to the next general election, posing further concerns for Prime Minister Rishi Sunak’s government.

Set to revise down its estimates for gross domestic product (GDP) in the second half of this year and early 2024, the central bank’s Monetary Policy Committee (MPC) has been alarmed by surveys and official data indicating an increased risk of recession.

A deviation from the previously predicted sluggish growth pace in August, this downgrade heightens the likelihood of an upcoming recession. Such a scenario would pose problems for Sunak, who must call an election before the end of January 2024.

The Conservative Party currently trails behind Labour in the polls and has suffered significant defeats in recent by-elections. Sunak’s attempts to reduce government spending and alleviate business burdens have failed to improve his popularity or stimulate growth.

“GDP growth has been weaker, the unemployment rate is higher, and pay growth is finally easing across all gauges. Financial markets have responded to the recent flow of news by pricing in a smaller-than-50 percent chance that interest rates will reach 5.5 percent, having previously expected over 6 percent in the summer,” Bloomberg Economists Dan Hanson and Ana Andrade explain.

Focus on Bleak Employment Outlook

On Thursday, the attention will primarily be on the BOE’s forecasts rather than the bank’s interest rate decision. Both investors and economists widely anticipate the MPC to maintain the key rate at 5.25 percent for a second consecutive meeting. The outlook is also expected to highlight an increase in unemployment to around 5 percent in the coming months, up from last year’s 50-year low of 3.5 percent.

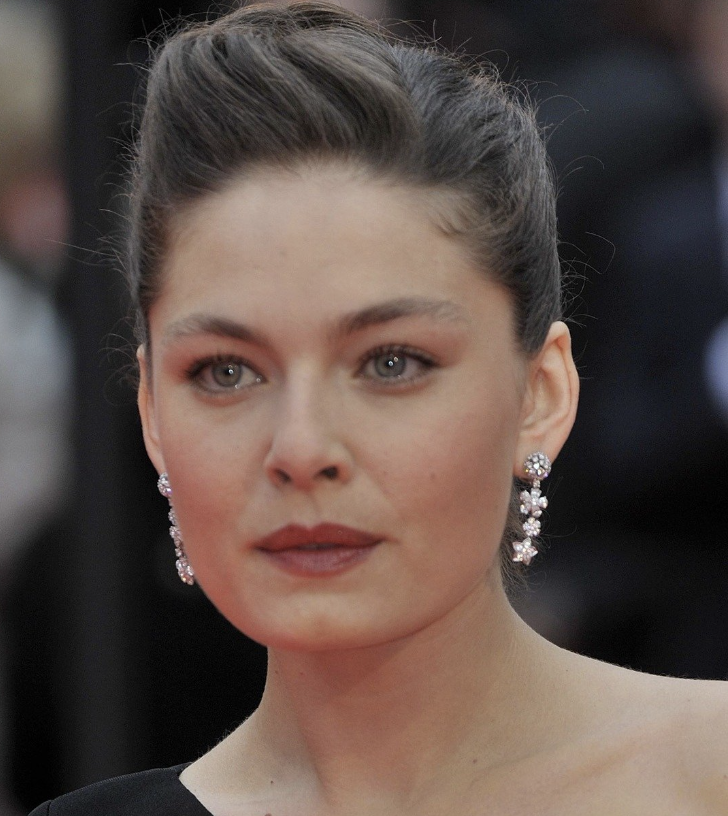

BOE Governor Andrew Bailey, having elevated interest rates to the highest since 2008, has indicated that borrowing costs cannot be reduced until inflation is well under control. Among the G7 nations, Britain currently struggles with the worst inflation problem, with prices rising at more than triple the 2 percent target.

Money markets have recently scaled back predictions of further monetary policy tightening due to signals from the European Central Bank and the US Federal Reserve suggesting that rate hikes may have already peaked. Consequently, the likelihood of a quarter-point BOE hike by early next year has decreased to around 40 percent, based on swaps tied to policy-meeting dates. Meanwhile, two cuts of 25 basis points each are expected by the end of 2024.

“We see limited likelihood of further hikes being required,” wrote Moyeen Islam, a rates strategist at Barclays Plc, suggesting that the monetary policy report will likely indicate policymakers’ satisfaction with the current interest rate level.

This situation is exerting pressure on growth. In the minutes of its previous meeting in September, the MPC stated that it anticipated GDP to only rise by 0.1 percent in Q3 of 2023, compared to the 0.4 percent increase projected in the August report. Additionally, it acknowledged that underlying growth was likely to be weaker than the 0.25 percent per quarter previously estimated for the second half of 2023. Most economists anticipate a downward revision in the GDP forecast for next year from 0.5 percent, with many also predicting a reduction for this year.

“For GDP, the near-term profile should be revised down based on recent monthly outturns, and we expect the Bank to maintain its weak outlook,” said George Buckley, chief UK and euro area economist at Nomura. He added, “As for unemployment, we think there are upside risks to the Bank’s profile.”

Looking beyond next year, economists believe that the outlook could improve. Simon French, chief economist at Panmure Gordon, highlighted recent positive revisions to the GDP levels for 2020 and 2021, a reduced risk of inflation expectations surpassing reality, and interest rate expectations stabilizing, which collectively have enhanced the medium-term prospects.

However, in the immediate future, Britain’s inflation rate stood at 6.7 percent in September, and an increasing number of economists foresee a recession in the forthcoming quarters.

I have over 10 years of experience in the field of cryptocurrency and blockchain technology. I have attended numerous conferences and events around the world, and my work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and Yahoo Finance.