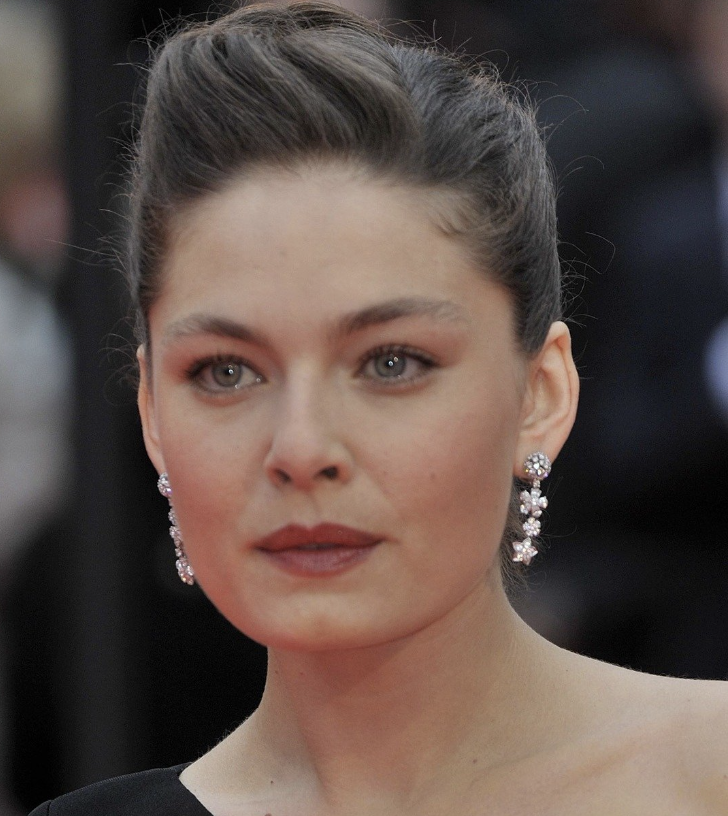

European stock markets ended on a sluggish note with a downward trend due to European Central Bank President Christine Lagarde’s warning of a possible resurgence of inflation. Speaking at a Financial Times event, Lagarde also noted that the ECB will not start cutting rates for at least “the next couple of quarters.”

In addition to Lagarde’s comments, the UK economy’s stalling in the third quarter took a toll on London’s FTSE 100 index, which ended down 1.3%. Frankfurt and Paris also suffered losses of almost one percent.

The Federal Reserve and the ECB have paused their rate-hike campaigns due to a slowdown in consumer price rises. However, they’ve indicated that they would keep rates higher for longer as inflation remains above their two-per cent targets.

Last week, equities saw an uptick in performance after Fed officials hinted that their long-running tightening cycle might be coming to an end. However, Fed Chair Jerome Powell indicated at an International Monetary Fund conference that achieving two-per cent inflation was “not assured” and that they would not hesitate to tighten policy further if necessary.

Meanwhile, the yield on the 10-year Treasury note eased on Friday after rising the day before. According to experts, the movement may have been tied to a ransomware attack on the US arm of China’s largest bank, the ICBC, which disrupted the US Treasury market.

I have over 10 years of experience in the field of cryptocurrency and blockchain technology. I have attended numerous conferences and events around the world, and my work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and Yahoo Finance.