Uncertainty looms over Israel and Gaza, creating a sense of unease among market participants. Analysts predict that safe-haven assets will remain in demand as risk aversion takes hold leading into the weekend. Craig Erlam, a senior markets analyst at OANDA, acknowledges the prolonged period of uncertainty and its impact on investor sentiment.

Meanwhile, Israel has taken aggressive actions in the region, leveling a northern Gaza district and issuing evacuation orders for the largest Israeli town near the Lebanese border. These actions, along with other signals, indicate that an invasion of Gaza is imminent.

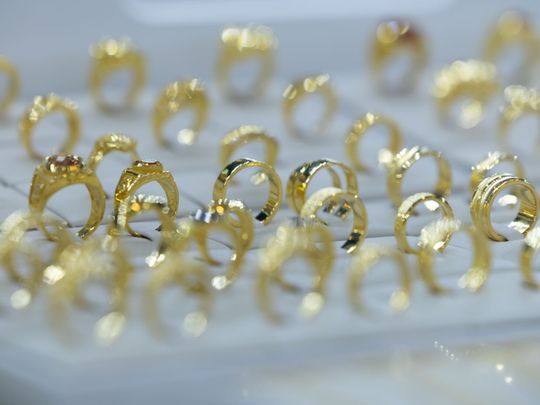

As a result of the escalating tensions, the price of gold has seen a significant boost. Over the course of this week, gold has risen by 2.5%, experiencing an increase of almost $150 since the conflict began. Analysts at Fitch Solutions note that gold has also been supported by diminishing fears of a Fed rate hike in 2023. With an average forecast of $1,950 per ounce for this year, gold remains an attractive investment option.

It is worth noting that higher interest rates can have a negative impact on gold prices, as they increase the opportunity cost of holding the precious metal. However, market expectations suggest that the Federal Reserve will maintain its current interest rate policy at the upcoming meeting, according to the CME FedWatch tool.

Technical analyst Wang Tao from Reuters predicts that spot gold will continue its upward trajectory, potentially reaching a range of $1,998 to $2,010 per ounce, as it has already surpassed an important resistance level at $1,972.

In addition to gold, other precious metals have also experienced notable movements this week. Spot silver has risen by 0.4% to $23.13 per ounce, while platinum has gained 0.8% and reached $897.45 per ounce. Both metals are on track for their second consecutive weekly increases. On the other hand, palladium has faced a decline of 0.7% and is heading for its fourth consecutive weekly decrease, currently priced at $1,106.21 per ounce.

I have over 10 years of experience in the field of cryptocurrency and blockchain technology. I have attended numerous conferences and events around the world, and my work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and Yahoo Finance.